Table of Content

As with all fixed rate loans, the benefit is knowing what your interest rate will be for the life of your loan. As a consumer, you’ll never have a sudden influx of rate, which makes budgeting easier. Chase offers terms ranging from 15 to 30-year fixed rates. Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information.

It is one of the largest finance institutions in the country with branches nationwide and online services. You do not have to be an existing customer to get a mortgage or refinance. Immediately following Chase has your complete software, you should buy a projected closing go out for the mortgage. The route and fare calculations provided on this site are estimates only. The fares are based on the published rates provided by the respective municipalities for travel within city limits.

Chase Home Equity Rates

Additionally you would like possessions advice like the assets kind of, purchase price and you can advance payment matter, and you may name and you may quantity of your real estate agent. Chase Home Lending offers rate-and-term, cash-out and streamline refinancing. The lender advertises its daily refi rates online, which you can view after you enter your zip code. Bankrate’s editorial team writes on behalf of YOU – the reader.

You might also be eligible for an additional $500 by completing a certified education course and getting a DreaMaker mortgage loan. It is only available if you are buying or want to do a no cash-out refinance of a primary home (1-4 units) for a 30-year fixed-rate term. Income limits and homebuyer education apply to a DreaMaker mortgage.

Mortgages

Prices may be updated from time to time

Some of these fees will be paid upfront or built into the mortgage balance, while others will be due at closing. You will receive a closing disclosure a few days before close that outlines all of the costs and fees you’ll need to pay. The new DreaMaker mortgage comes with the versatile investment alternatives for settlement costs , quicker individual mortgage insurance coverage criteria and lower monthly premiums. Even when Pursue signature loans aren’t readily available, many other Chase Loans from banks are provided so you’re able to customers. You can get financing estimate with the Pursue individualized rates and you will percentage quote product towards the the website. Gather debt pointers, including your domestic income, expense, unsecured loans and you can possessions.

Is Chase Bank A Good Place To Get A Home Loan?

As of August 2022, the APR on their loans ranged anywhere from 4% to 7% depending on the area, type of mortgage loan and market rate trends. Pursue Lender features personal loans that have rates and you can terms one to depend on your own borrowing and other circumstances. Find out what Pursue financing are around for you, just what Chase unsecured loan costs you could be eligible for and determine if any suits your very own financing bundle. The Coworking space Mindspace Ahad Aha’am offers a lot and beyond what you dared to hope for. Not only it is in one of the best locations, it has impressive design, a variety of necessary services and flexebility in terms of rental conditions. Among others the tenants in the Co-working space Mindspace Ahad Aha’am that’s located at אחד העם 54, תל אביב enjoy a variety of comprehensive and economic benefits.

Washington Mutual was an innovator in mortgage lending and retail banking. JP Morgan acquired WaMu to escape bankruptcy in 2008 during the economic crisis. JP Morgan Chase and Company’s roots date back to 1799 as a bank started by Aaron Burr, Alexander Hamilton’s political enemy, in New York. JP Morgan Chase grew to its current size by absorbing a number of large banks over the years. Today, the financial institution is actually a combination of 1200 different banks.

However, you will have to meet income requirements to qualify for this loan. Due to the fact a customers, you should buy Pursue Loans from banks for different kind of mortgage loans including to find an automible. The annual percentage rate , is the cost of credit over the term of the loan expressed as an annual rate. It does not take into account the processing fee or any other loan specific finance charges you may be required topay. In most cases, you will be required to have a credit score of 600 in order to be eligible for a personal loan through Chase.

If you want an alternative to a Chase personal loan, online lenders are a great place to start. Personal loans on BadCreditLoans.com are typically cheaper, fees are lower, and the turnaround time is faster. At BadCreditLoans.com, you can get a personal loan of up to $35,000 with reasonable terms and conditions. If you want your lenders to review your application, fill out the MoneyMutual form with all of your information. Chase Home Lending, a division of JPMorgan Chase & Co., was established in 2000 and is one of the top mortgage lenders in the U.S.

Working with an adviser may come with potential downsides such as payment of fees . There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. DreaMaker® and FHA loans are similar in nature, as they each allow for loans to be had with down payments of around 3% or slightly more. This could prove invaluable for certain clients who are hard-pressed for short-term cash but have the ability to pay month-to-month. You can begin the application process online from the mortgage section of the Chase website.

You can also get up to $1,150 off your processing fee with combined assets totaling at least $500,000. Whether you're a first-time homebuyer, need to expand or downsize, or are looking for a second home, Robin is here to help you find the right mortgage to fit your needs. Starting with a review of your finances, Robin can help you get a clear picture of what might work best for you.

Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value estimator to estimate the current value of your home. See our current refinance ratesand compare refinance options.

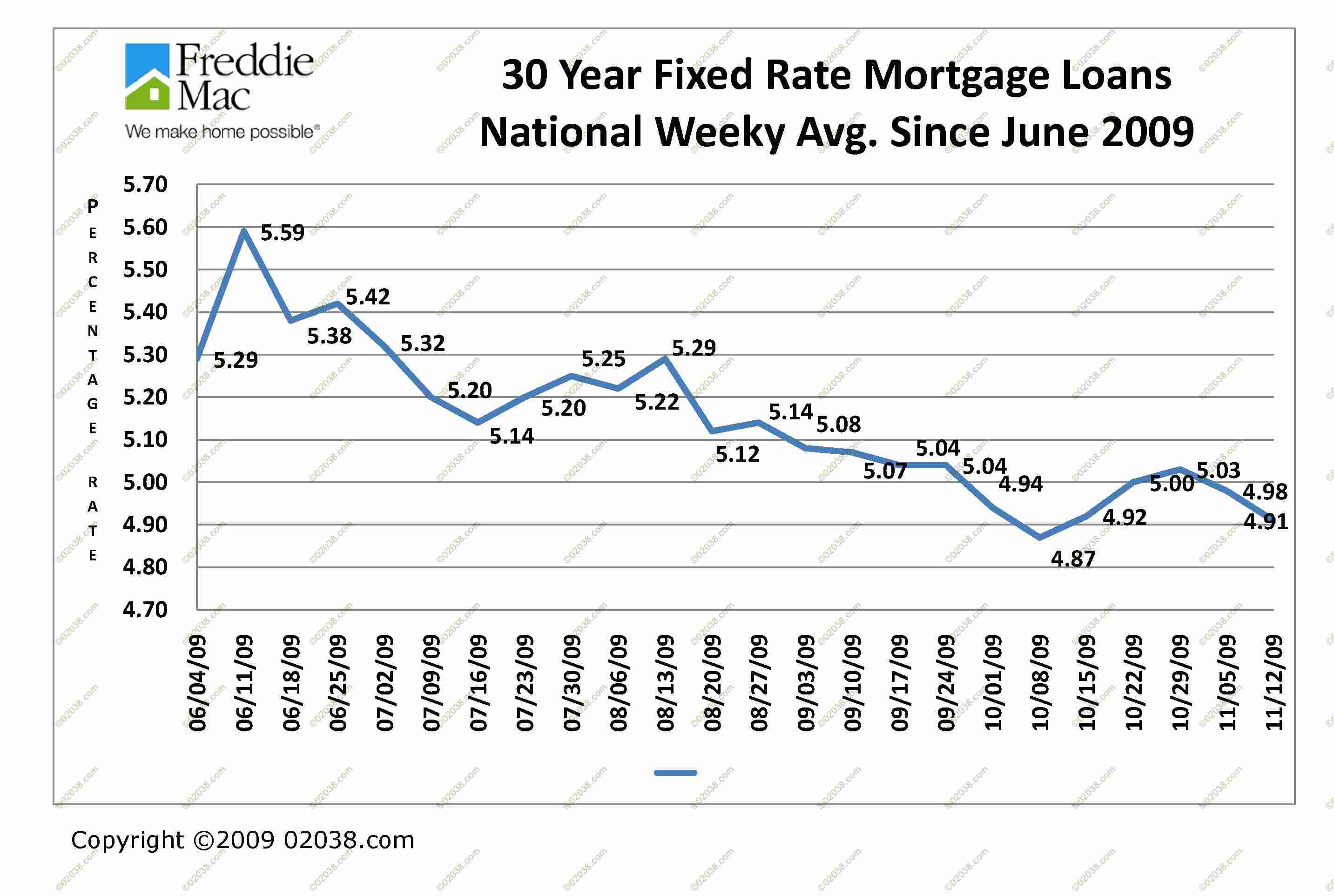

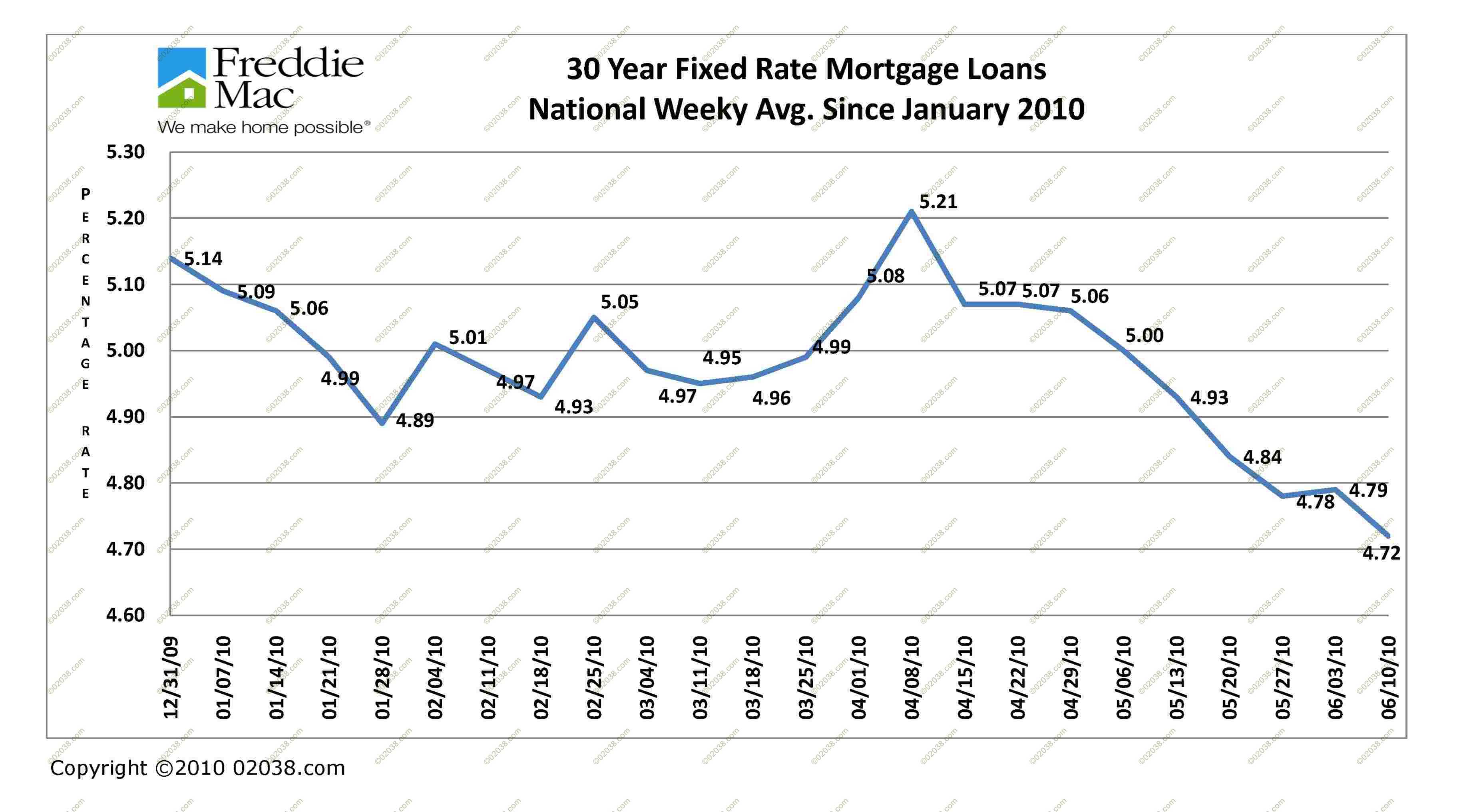

Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. During the first part of 2022, rates for home loans rocketed and currently sit at about 6.61% for the popular 30-year fixed-rate mortgage. Experts are divided on whether they’ll continue to climb—some forecasts put the year-end average at nearly 7%—or stay flat from here. If you’re in the market for a mortgage, you should check rates frequently, and always comparison shop for lenders.

No comments:

Post a Comment